Sustainable supplies prepares the following aging of receivables analysis – Sustainable Supplies: Unveiling the Aging of Receivables Analysis introduces a comprehensive analysis of sustainable practices in supply chains and their impact on aging receivables. This exploration unveils the significance of sustainable practices in mitigating environmental concerns, enhancing social responsibility, and optimizing credit management strategies.

By delving into the intricacies of aging of receivables analysis, we uncover its purpose, benefits, and key metrics. This analysis empowers businesses to assess the health of their receivables, identify areas for improvement, and develop effective action plans to enhance cash flow and financial performance.

Sustainable Supply Chain Practices

Sustainable supply chain practices are crucial for reducing environmental impact, improving social responsibility, and ensuring long-term business viability.

By implementing sustainable practices, businesses can reduce greenhouse gas emissions, conserve resources, and minimize waste throughout their supply chains.

Examples of sustainable practices include using renewable energy sources, reducing packaging, and sourcing materials from suppliers with ethical labor practices.

Environmental Impact

- Reduce greenhouse gas emissions by using renewable energy and optimizing transportation routes.

- Conserve resources by reducing waste, using recycled materials, and implementing water conservation measures.

- Minimize pollution by reducing the use of hazardous chemicals and implementing waste management systems.

Social Responsibility

- Ensure fair labor practices by sourcing from suppliers that comply with ethical standards.

- Promote community development by investing in local suppliers and supporting social programs.

- Respect human rights by ensuring that workers are treated with dignity and respect.

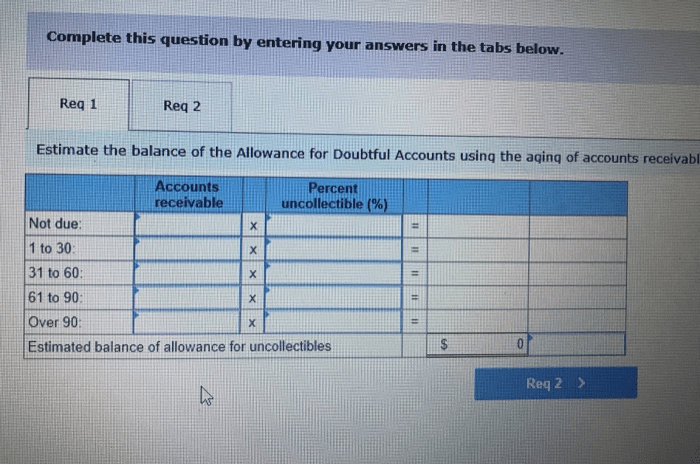

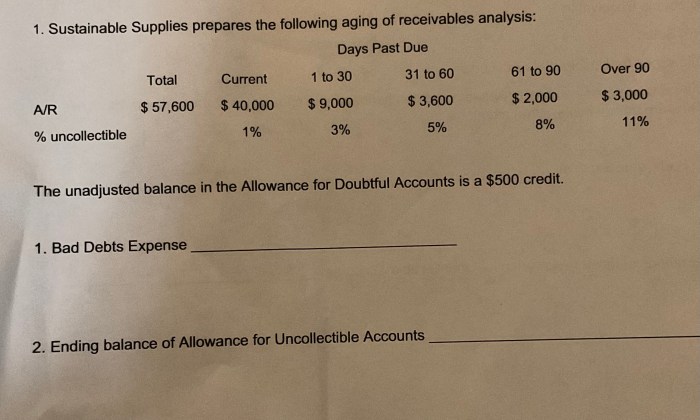

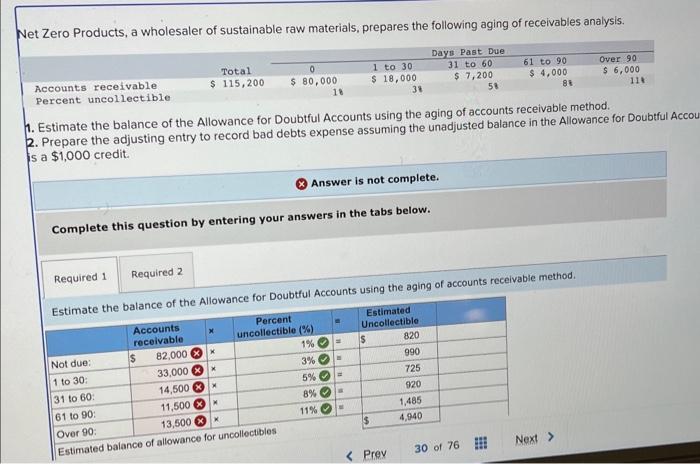

Aging of Receivables Analysis

Aging of receivables analysis is a financial tool used to assess the creditworthiness of customers and identify potential cash flow problems.

By analyzing the age of outstanding invoices, businesses can gain insights into their collection effectiveness and make informed decisions regarding credit policies and collection strategies.

Purpose and Benefits, Sustainable supplies prepares the following aging of receivables analysis

- Identify customers with overdue invoices.

- Estimate potential bad debts and reduce credit risk.

- Improve cash flow by prioritizing collection efforts.

- Identify trends and patterns in customer payment behavior.

Key Metrics

- Average Days Sales Outstanding (DSO): Measures the average time it takes to collect invoices.

- Current Receivables: Invoices that are less than 30 days old.

- Aging Buckets: Categories that classify invoices based on their age, such as 30-60 days, 60-90 days, and over 90 days.

Data Collection and Analysis

To conduct an aging of receivables analysis, businesses must gather data from their accounting system or other relevant sources.

The data should include customer information, invoice details, payment history, and the age of outstanding invoices.

Data Collection Plan

- Determine the data sources and extract the necessary information.

- Establish a data collection frequency and schedule.

- Ensure data accuracy and completeness by verifying and validating the data.

Analysis Methods

- Calculate DSO and aging buckets.

- Create a Pareto chart to identify the customers with the largest overdue amounts.

- Trend analysis to identify changes in payment behavior over time.

HTML Table

| Aging Bucket | Current Receivables | Percentage ||—|—|—|| 0-30 Days | $100,000 | 50% || 30-60 Days | $50,000 | 25% || 60-90 Days | $25,000 | 12.5% || Over 90 Days | $15,000 | 7.5% ||

- *Total |

- *$190,000 |

- *100% |

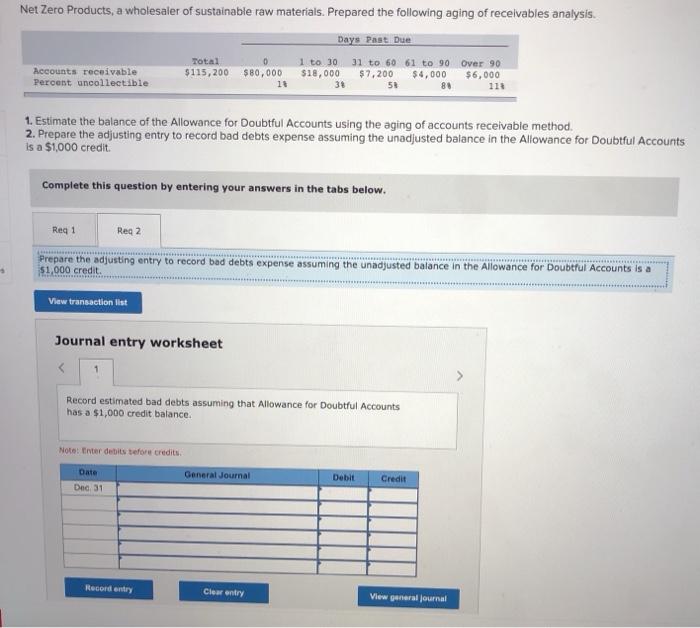

Interpretation and Action: Sustainable Supplies Prepares The Following Aging Of Receivables Analysis

The results of the aging of receivables analysis should be interpreted in the context of the business’s overall financial performance and industry benchmarks.

Businesses should identify areas for improvement and develop an action plan to address any issues identified.

Interpretation

- High DSO or a significant increase in aging buckets may indicate collection problems or credit risk.

- Customers with a large proportion of overdue invoices may require special attention or collection efforts.

- Trends in payment behavior can provide insights into the effectiveness of credit policies and collection strategies.

Action Plan

- Revise credit policies to reduce credit risk and improve collection effectiveness.

- Implement collection strategies to prioritize overdue invoices and follow up with delinquent customers.

- Offer discounts or incentives for early payment to encourage timely payments.

- Monitor the aging of receivables analysis regularly and make adjustments to the action plan as needed.

FAQ Insights

What is the significance of sustainable practices in supply chains?

Sustainable practices in supply chains play a crucial role in reducing environmental impact, enhancing social responsibility, and ensuring the long-term viability of businesses.

How does aging of receivables analysis benefit businesses?

Aging of receivables analysis provides valuable insights into the health of a company’s receivables, enabling businesses to identify overdue invoices, assess credit risk, and implement strategies to improve cash flow.